Independent contractors – what it means for you

The most important thing to know about your taxes is that you are not a traditional employee of that company. You are what is commonly known as an independent contractor. This affects how you file your taxes and the way you treat your record keeping all year.

What does Independent Contractor mean? In tax terms, this means that you are self‐employed. You are the owner of your business (think of yourself as the boss AND the employee). When you receive your check from Uber, let’s say, this is not a traditional paycheck and there have been no taxes taken out or withheld on your behalf. It is up to you to take care of your Federal and State taxes, we well as Social Security and Medicare. See this blog post by Shared Economy CPA for additional information about quarterly estimated income taxes and if you are liable for them.

What is the single most important thing to remember?

While there are a couple of ways to file your taxes, they both share one important salient feature: being extremely meticulous in keeping records. The more records you keep, the more you will be able to deduct, and the less likely you are to be audited. We cannot stress this enough! The single most responsible culprit to not maximizing your deductions is not being organized enough to keep track of all the pennies you spent building up your business and pennies, as we all know, add up fast.

The Basics

Revenue

You will receive a 1099 from your rideshare partners. This is what you earned through the year driving with them. Your rideshare company will probably directly deduct the commissions you pay to drive for them right from your check.

It will probably be filled up with lots of big numbers (we are optimists!) and will provide you with your take home amount from that company (Item 1a).

Expenses and Deductions 101

What are Deductions?

As a self‐employed driver, you can directly deduct the ordinary and necessary costs of running your business from your gross income. The most obvious tax‐deductible business expenses are the expenses you incur for your car.

There are two ways to claim deductions as a business expense. You can only claim one method and not both!

- Deduct the actual expenses of using your car for business, including gasoline, oil, repairs, insurance, maintenance and depreciation, or lease payments.

- Take the standard IRS mileage deduction for each business mile driven. For 2015 taxes, the allowed rate is 57.5 cents per mile. For 2016, the IRS has announced the rate is 54 cents per mile (mostly to reflect the lower cost of gas).

Since you probably use your vehicle for both personal and business use, you can only deduct the portion of your actual expenses that apply to your business use. Be sure to have good records for all of your deductions; good examples of backup support for your deductions would be receipts and mileage logs.

Be sure to access your personal dashboard and capture all of the expenses that have been charged to you and not shown on your 1099. SherpaShare helps track miles that are driven to and from jobs – the ones that Uber and Lyft don’t count. Yes, you can claim these miles driven as well if you choose to use the standard IRS mileage deduction or the gas used to drive them as an itemized deduction.

In addition to the deductions claimed using one of these two methods, you can also claim what are classified as Common Operating Expenses. We will cover these in detail later.

When will I receive my 2015 tax information from Uber, Lyft?

What method should I use?

The simple answer is, how good are you at tracking your expenses? If you are a meticulous book keeper, you can claim more accurately using the Actual Expenses method.

Standard Mileage Deduction

This is the easiest method to use. You get a flat 57.5 cents per mile driven while working during 2015. Did you know that you can claim the miles you drove to and from your jobs as well? Since Uber, Lyft and other rideshare companies only count the miles you drove on the clock, make sure you log into SherpaShare dashboard and get all the miles you drove to file a more accurate and larger deduction. Let SherpaShare do your work for you.

Where to file?

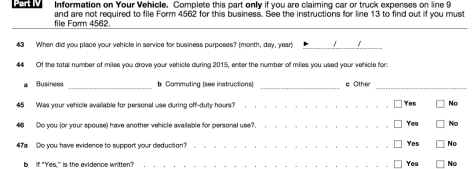

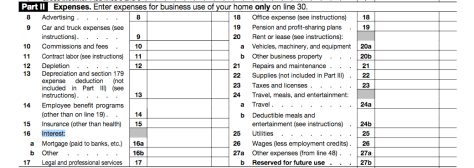

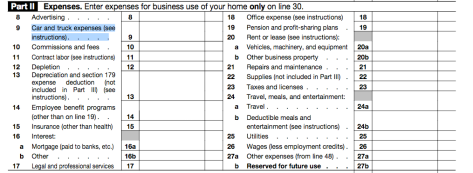

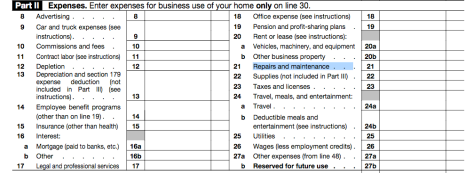

Line 44 Option (a)

This follows to item 9. in Part 2 of the form.

Actual Expenses Method

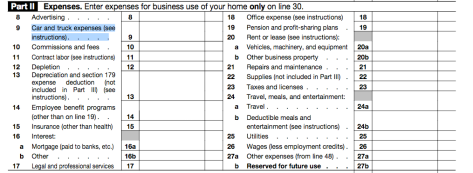

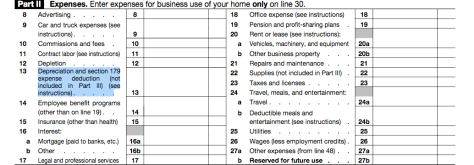

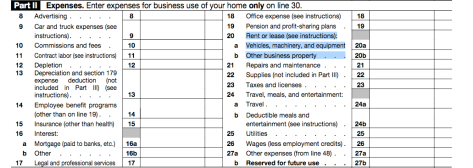

Did you buy a car and use it to use to drive for your ridesharing business in the first year? You might be eligible for a huge deduction! Did you keep meticulous records all year? Let us guide you through what you may or may not be able to claim. All these will be filed on Schedule C of Form 1040.

Depreciation

You can depreciate your car over a time period of 5 years. There are a few ways to do this but basically you can take the entire current value of the car and claim it as a deduction over the course of your ownership.

Of course, you would like to claim the entire depreciation in the first year itself! If you have bought a car this year that is over 6,000 lbs and under 14,000 lbs and used it to drive for your ridesharing business – you can claim up to $25,000 as a special Section 179 deduction using form 4562.

Cost of Lease

Don’t own your car? You can deduct that part of the lease during which you use the car for work. If you use your car half the time for Postmates and half the time for personal use, you can deduct half the lease amount.

Interest on Auto loan

You can claim that part of your auto loan as a deduction that you used your car as a percentage of total usage.

Gas

You can deduct all business related gas usage. This includes driving too and from work and any classes you might take to help you further your future in the rideshare economy. Make sure you use the SherpaShare tracking app to give you an accurate number at any time you feel like checking.

Repairs and maintenance

You can deduct the percentage of what it cost you on repair and maintenance that went towards operating your business.

Operating Deductions

In addition to one of the two ways above – all drivers can claim the following deductions

● Car washes and interior maintenance and cleaning (100% of cost)

● Water, snacks and gum for passengers (50% of cost)

● Tolls and parking fees (100% of cost)

● The portion of your mobile phone that is attributable for your business

New changes to note

For individuals utilizing the SherpaShare platform, it’s important to stay up‐to‐date on the latest requirements. For these reasons alone, we have partnered with Shared Economy CPA to provide you with the latest tax updates for 2016 to help you.

Below is a list of some of the new changes in taxes for 2016:

● Taxes Due April 18th, 2016: Tax day is April 18th this year. Since the Washington DC holiday of Emancipation Day is on Friday April 15th, Federal law says that the tax deadline gets extended when it falls on a holiday or weekend, so the tax deadline for most taxpayers will be Monday April 18th, 2016.

● Standard Mileage Deduction: You may have noticed that gas prices have been steadily decreasing. Congress has noticed this trend also, so for the first time, the IRS has announced that the 2016 standard mileage rate for the business use of your vehicle has gone down to 54 cents per mile, down from 57.5 cents in 2015. Be sure to track all of your mileage, including actual expenses to capture the highest possible deduction for your business.

● Affordable Care Act Penalties: Tax penalties related to the Affordable Care Act (Obamacare) are going up. The ACA has imposed penalties for not having qualifying health care coverage. See our prior blog post here. The penalties originally started out at $95 per adult, or 1% of income over the filing threshold. In 2015 it rose to $285 per adult, or 2% of the income over the threshold. For 2016 it will be a whopping $695 per adult, or 2.5% of income.

Lastly, since last year’s income tax season was marked by an explosion of refund theft, increased protections from the IRS that may cut down on fraud will likely draw out the wait for your refund check.

Top 5 tax deduction tips for the 2015 Tax Season

1. Expenses while you’re traveling

If you travel while for business purposes (i.e. you live in Los Angeles, but driving down to San Diego for ComicCon for the weekend to Lyft, Uber, or Sidecar) there are some great tax deductions that you can take. Examples of things that can be deducted are: travel to destination, lodging, and meals. When deducting expenses related to traveling, it is important to be able to prove the business purpose for the expense or the potential business benefits gained (or expected to gain). Another type of business travel expense I’ve heard is from a rideshare driver who drove up to San Francisco to meet with members of his platform to get new insights on the rideshare industry and how to become a better driver and get higher ratings.

2. Education Credits

Many rideshare drivers are also part time/full time students – this is great from a tax savings perspective! One of the most beneficial tax deductions is the American Opportunity Tax Credit, which is a refundable tax credit! A refundable tax credit means that even if you owe no taxes, you can get a refund (i.e. payment from the government). To qualify for this credit, you need to be a student that is enrolled in college, accredited post-secondary educational institution, or university at least halftime. The credit applies to 100 percent of the first $2,000 in qualifying education expenses, and 25 percent of the next $2,000 expenses for a maximum credit of $2,500!

3. Bank Fees

If you set up a bank account for your rideshare income and/or use your bank account for direct deposits, then proportionate share of your bank fees related to that card are deductible! For example, you set up a new credit card for your rideshare income using an Amex, the fees related to setting up the card and paying annual dues are tax deductible. You pay to save.

4. Simplified self-employed pension plans

Saving money for your retirement is a great long term financial decision – especially if you set up a Simplified Employee Pension plan, also known as a (“SEP ”) plan. Under a SEP plan, a person is able to contribute 25 percent of their earnings up to a $53,000 maximum for 2015. The SEP plan is tax deductible so it is important to save money for this plan as you can deduct it from your income while planning for your retirement!

5. Start-up Costs

You can deduct up to $5,000 in business startup costs in the first year of business (the $5,000 amount is reduced by the amount that the startup costs exceed $50,000 and any remaining costs must be amortized). For example, if you need to get new tires for your car to comply with Ubers Raiser or you needed to pay for the Raiser inspection, these types of expenses typically qualify as startup expenses and can be deductible.

How do I get my 2015 mileage I tracked from SherpaShare?

We hope that this guide helps answer most of the questions you might have thought of this tax season. Anything we have missed out? Email us!

The information contained in this website is meant only for guidance purposes and not as professional legal or tax advice. Further, it does not give personalized legal, tax, investment, or any business advice in general. For professional consultation, please sign up with us or visit a CPA.

I noticed on my 1099 from Uber that they are reporting the Gross amounts earned and did not deduct commissions paid to the company. They did enter the commission amounts on the Year End Statement with the note please talk to your tax preparer on how to receive the deduction. How would I go about reporting these amounts?

LikeLike

Bob

LikeLike

Sherpashare where is your customer and technical support??? I have been trying to contact you forever in regards to how your app doesn’t work on android

LikeLike

Hi – email sherpashare founder ryder@sherpashare.com for a quick reply.

LikeLike

I did

LikeLike

Ya I tried to use the spp on my gslscy and I have had no success

LikeLike

Ooops sorry about those typos

LikeLike

Interest on your car loan is deductible in addition to the standard mileage deduction. In addition, I see no reason water, snacks and gum wouldn’t be 100% deductible. And as I commented last time you ran this, the travel deduction is questionable, it’s more likely the IRS would consider this commuting miles and not allow the deduction.

LikeLike