Happy New Year! Hundreds of thousands of drivers like you are starting to think about taxes, expenses, and mileage tracking – and we are definitely here to help this tax season.

Our one page guide to get you started

Last year, one of our tax videos was included in our NYTimes feature. It gave a step-by-step guide on how to efficiently file your rideshare taxes.

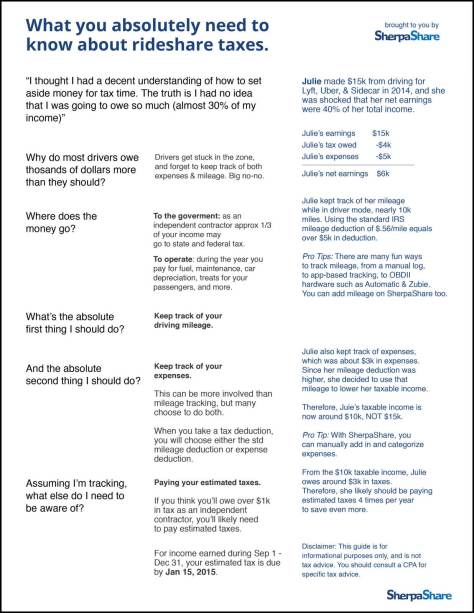

Exactly a year ago we published a one-page guide to filling taxes as an independent contractor. We’ve pulled it from the archives and here it is:

The key takeaways

Start tracking mileage and expenses now. Our app is just one of the free options, there are many out there. When you file for these in 2017, you’ll be able to choose what works best for you – deducting miles or deducting expenses – but if you don’t have the record, you have no choice.

Add in mileage and expenses for this year. For this year, which concerns most of you, you can retroactively add in mileage you’ve tracked and export it from our website. We’ve included a few tips on how to do that in a recent post.

What to expect in the weeks ahead

In the coming few weeks, we’ll have more posts, advice, and more to help you maximize your deduction, whether or not you’re using SherpaShare – so check back.

UPDATE: You can download your 2015 mileage information tracked on SherpaShare under “Get 2015 Report” on the Dashboard

If you want to go back through past posts, here are two more recent posts:

- How to ensure your mileage tracking is IRS compliant

- The new 2016 IRS mileage deduction rate could cost you hundreds of dollars

Like these tips? Share with others

Your mileage is the most important expense to track but don’t forget other expenses. Off the top of my head, here are a few:

Phone & Monthly access fees (if you use your regular phone you can deduct a portion of the monthly fee.)

Car mount/charger/case/bluetooth or handsfree device for phone

Subscription fees for XM, satellite or Internet radio or traffic information services

Snacks and water if you provide them to customers

Car wash costs (these are not included in the standard mileage)

Cleaning supplies, including barf bags

Road safety items such as flares, flashlights, reflective vests, tool kits, jumper cables, fire extinguisher ect.

Personal safety items such as dash cams, pepper spray, tasers or any other legal weapons you carry. Guns are usually deductible if you can prove that you need it for safety, do not use it outside of work AND it is legal for you to carry them for your job, concealed or visible AND the company you drive for allows you to carry a weapon. (Uber and Lyft do not)

Any additional “reasonable and necessary” accessories for your car such as tinted windows, car seat/steering wheel covers or cup holders/car organizers, trade dress signs, roof racks if you transport bikes or skis, ect.

Tablets, aux cords, phone chargers, child seats, pet carriers or blankets or any other item you purchase for rider use or to protect the car from riders

Travel expenses-If you find yourself so far from home that you decide to stop to sleep you can deduct the cost of a hotel room and any meals or just meals if you stop at a rest stop to sleep. If you are working during normal meal times and too far from your home to return to eat you can deduct the cost of those meals as well. Generally the IRS considers 50 miles or one hour of drive far enough away.

These kind of expenses will be minimal compared to your mileage but if you keep track of them and deduct the expense you are basically giving yourself a 30% discount on those items.

LikeLike

All of the expenses I listed above are in addition to the standard mileage rate.

LikeLike

How about gas??

LikeLike